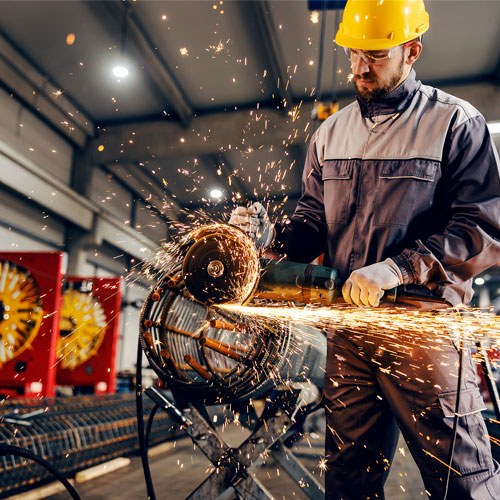

Equipment for virtually any industry.

Equipment Financing

Loan Amount

Term

Cost

Repayment

The tools for success.

Equipment financing helps business owners get the funds necessary to purchase or lease any type of equipment. From refrigerators to computers, our funding programs work with the flexibility you want without putting a strain on your business's cash flow. There may even be equipment financing options available to startups and businesses with low credit.

Exact qualifications vary by lender and equipment type.

- 12+ Months In Business

- 650+ Credit Score

- $50,000+ Annual Revenue

- Quick & Easy Application

Don't worry if you don't meet all of these requirements. For example, if your credit score is lower than 650 but you can show proof of solid cash flow and revenues for the past 3-6 months, you can still qualify. The best way to figure out what you qualify for is to fill out our free 15-minute application or get in touch with one of our personal funding managers.

You can finance just about any kind of business equipment.

Many small business owners hear about equipment financing and think of tractors and backhoes. Yes, construction equipment is totally financeable - but so is a bunch of other equipment. In fact, there's an equipment financing option to cover tools and resources for just about every small business industry. Big or small, basic or complicated - whatever you need, we'll help you cover the costs.

Costs can vary as much as your equipment.

Your equipment loan payments are determined by four things: your loan amount, interest rate, term, and collateral. These factors can vary widely across industries and equipment types. That's why we work with a variety of lenders who specialize in industry-specific loans - so we can help you find the best deal.

It's Time To Get Funded

30 second application with no fees